Here are seven things to keep in mind once you reach the age when you must withdraw required minimum distributions (RMDs):

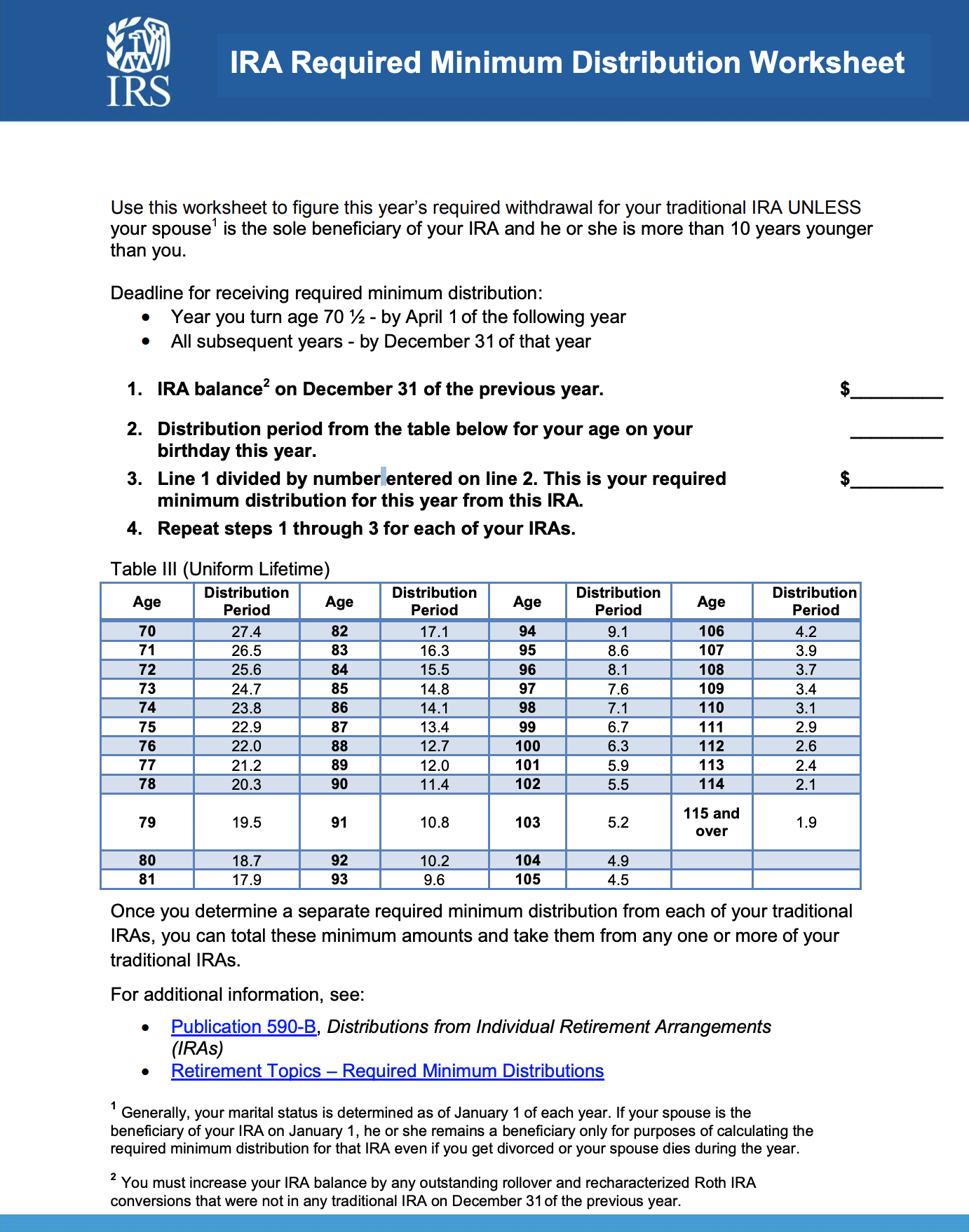

- Starting at age 70 ½, you have to withdraw a percentage of money from many types of retirement accounts based on the previous year’s ending values of those accounts. The minimum amount you must annually withdraw is called a required minimum distribution and based on one of two schedules that depend on your marital status and the age difference between you and your spouse.

- Withdrawals from pre-tax retirement plans can be taxed as current income.

- If you have remaining employer-sponsored retirement accounts, such as a 401(k) or 403(b), you will have to withdraw your RMD from that account — unlike IRAs, which allow you to choose which account you take the withdrawal from. So, if you wanted to, you could take all of the RMDs from a single IRA. But, that’s not how it works for employer-sponsored investment accounts.

- You must calculate your first RMD the year you turn 70 ½. However, the first payment can be delayed until April 1 of the year following the year you turn 70 ½. For all subsequent years, the RMD must be made before December 31. If you delay the initial year’s payment of the RMD to April 1, you will still have to take the current year’s payment by December 31.

- If you fail to withdraw your correct RMD amount(s) by the deadline, the IRS has the right to impose a fine of 50% of the value you failed to take out, in addition to the taxes on that balance.

- There are specific RMD rules for survivors taking distributions from spouses’ or parents’ IRAs.

- You can make qualified charitable distributions (QCDs) directly from your IRA accounts to a qualified charity and have those contributions count toward your RMD. Monies distributed in this manner are not included in your adjusted gross income.

So, RMDs can be complicated and should be taken seriously. Contact us to set up a retirement blueprint for you and your RMDs to help you avoid mistakes during your mandatory withdrawal period.